From the start of the coronavirus outbreak, many industries looked on with concern, wondering how it would affect their business — their logistics and processes, their revenues, and of course, their employees. This is just as true of those in the messaging industry, both providers and MNOs, since the quarantine has affected their primary source of income: companies generating messages.

As some countries start to open up, others initiate their first (belated) lockdowns, and others see resurgences in virus cases, we take a look at some of the outcomes — and the variables affecting those outcomes — experienced by the telco industry.

Declining A2P traffic — a question of use cases

The question “has traffic decreased or not?” does not actually have a single answer, unless that answer is “it depends on the use case.”

Our experts saw a predictable fluctuation in promotional and notification messages. With fewer businesses operating, there were fewer reasons for them to send advertising and marketing messages. It just did not make sense. The exception, of course, was notifications from online retailers, or those retailers who were able to transition to an online service — these businesses obviously started generating more SMS messages as consumers needed to order more and more goods online.

Meanwhile, there was a similar rise in authentication OTPs. With many offices transitioning to a work-from-home model, the productivity tools they used started triggering more A2P messages to ensure the integrity of logins coming from IP addresses other than that of the office. We also observed a similar trend with social network traffic, with more people signing in or downloading apps, as they sought new ways to connect with one another — all of which generated more authentication traffic.

As far as MNOs are concerned, then, there has been relatively little disruption in traffic amounts. Many saw a drop in traffic, naturally, but it turned out to be far smaller than you would otherwise think.

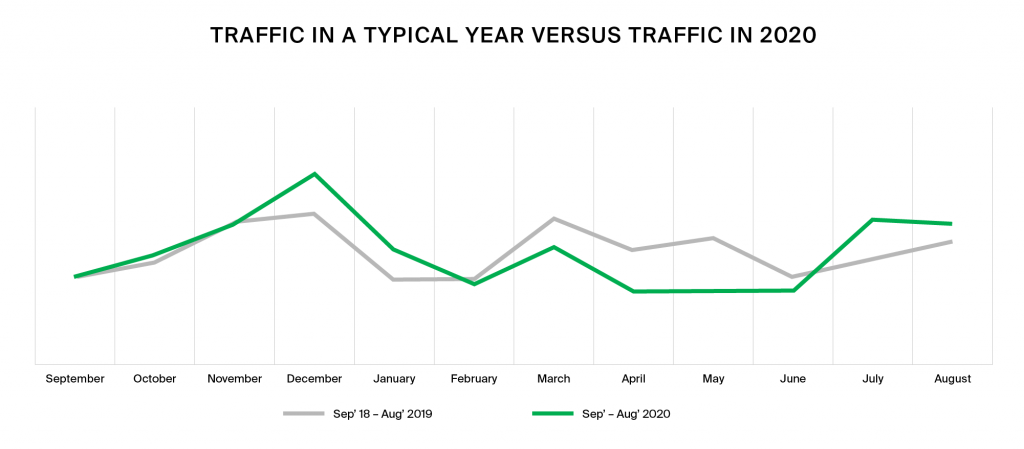

Historical seasonality

Usually, A2P traffic drops off during summer when many customers take their vacations. With fewer authentications or deliveries taking place, messaging traffic drops off.

However, during the lockdown, many vacations have been cancelled or delayed. Consequently, traffic has remained at levels we usually see outside of the summer holiday season. Interestingly, we have seen a delayed fluctuation in areas where quarantine conditions are gradually easing, as people take their holidays (even where they need to take this within their home country, as “quarantine staycations”).

Regional variations

Of course, different markets have seen variations, due in no small part to differences in how they have been affected by the virus and their response to it. Those with tighter restrictions have seen a sharp decline in promotional messages — but they also saw an unprecedented rise in authentication messages and delivery notifications that in some cases exceeded the drop in promotional SMS traffic.

To a certain extent, our observations were matched by those presented by Mobilesquared at a recent MEF webinar on the effects of Covid-19. They observed an increase in traffic in North America, Oceania and Western Europe — all markets with well-developed business messaging and online retail sectors, as well as stringent authentication and data protection requirements.

(Mobilesquared also noted some interesting variations between industry use cases. For example, logistics and delivery have seen a significant increase, while automotive uses have seen a steep decline).

RCS

Also mentioned in the MEF webinar was RCS. Predictably, RCS deployments have been slowed by the virus and quarantine.

MNOs have had other priorities as they consider changes in usage — for example, some are seeing a decline in revenue from pay-as-you-go subscribers on tight budgets who can’t afford to top up. Mobile internet usage has also fallen in those territories under quarantine, as people connect via their home WiFi, further affecting revenues. Meanwhile, enterprises are also reassessing their priorities, as mentioned above, so how many will be ready to launch a new, complex — and expensive — campaign? There is simply no RCS business case for some operators.

These factors (and others) have negatively impacted RCS rollouts, and various sources are predicting slower growth than previously expected just three or four months ago.

Overall traffic

In general, A2P traffic has been remarkably unaffected by lockdowns around the world. Decreased traffic from some sources has been compensated for by rises from others. Consequently, we have actually seen a natural growth of 4-6% in most markets, and Mobilesquared has said that their year-end traffic predictions for 2020 have only lowered by 2bn messages post-Covid (compared with those predictions made earlier).

From our position, GMS believes that these developments have demonstrated the value of A2P messaging for both enterprises and operators. We have even had several MNOs approach us to find out more about securing their SMS connections with GMS Messaging Protection. After seeing the health and — in particular — the resilience of A2P messaging, operators are looking to further secure and exploit the revenue opportunity they have before them.